Filter by

SubjectRequired

LanguageRequired

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired

LevelRequired

DurationRequired

SkillsRequired

SubtitlesRequired

EducatorRequired

Explore the Computational Finance Course Catalog

Skills you'll gain: SAS (Software), Data Import/Export, Predictive Modeling, Data Manipulation, Statistical Analysis, SQL, Feature Engineering, Data Analysis, R Programming, Data Cleansing, Regression Analysis, Software Installation, Statistical Hypothesis Testing, System Configuration

University of Pennsylvania

Skills you'll gain: Demography, International Finance, International Relations, Political Sciences, Market Trend, Socioeconomics, Trend Analysis, Social Sciences, Cultural Diversity, Economic Development, Sociology, Consumer Behaviour, Financial Systems, Economics, Business, Business Economics, Analysis, Governance

Status: New

Status: NewCoursera Instructor Network

Skills you'll gain: Generative AI, Exploratory Data Analysis, Data Ethics, OpenAI, Data-Driven Decision-Making, Analytical Skills, Artificial Intelligence, Data Analysis, Prompt Engineering, Pandas (Python Package), Automation, Data Visualization Software, Descriptive Statistics

Skills you'll gain: Cyber Risk, Cyber Security Strategy, Risk Mitigation, Cybersecurity, Security Management, Risk Analysis, Security Strategy, Information Management, Law, Regulation, and Compliance, Financial Services, Regulatory Requirements, Asset Protection, Business Continuity, Digital Assets

Status: Free

Status: FreeSkills you'll gain: Financial Statements, Financial Statement Analysis, Business Planning, Income Statement, Balance Sheet, Financial Analysis, Small Business Accounting, Financial Accounting, Profit and Loss (P&L) Management, Business Strategy, General Finance, Cash Flows, General Accounting, Business Analysis

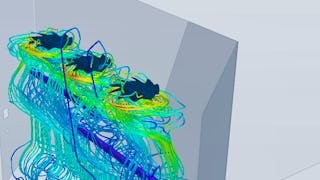

Siemens

Skills you'll gain: Engineering Analysis, Thermal Management, Simulation and Simulation Software, Simulations, Mechanical Engineering, Numerical Analysis, Engineering, Mathematical Modeling, Differential Equations, Physics

Status: New

Status: NewCoursera Instructor Network

Skills you'll gain: AI Personalization, Customer Insights, ChatGPT, Generative AI, Call Center Experience, Prompt Engineering, Customer experience improvement, Customer Engagement, Customer Service, Workflow Management, Process Optimization, Self Service Technologies, Artificial Intelligence, Business Process Automation, Automation

Status: New

Status: NewUniversity of Maryland, College Park

Skills you'll gain: Global Marketing, International Relations, International Finance, Cultural Sensitivity, Business Risk Management, Market Dynamics, Economics, Business Strategy, Political Sciences, Supply Chain Management, Market Analysis, Brand Management

Status: New

Status: NewSkills you'll gain: Data Structures, Graph Theory, Algorithms, Computational Thinking, Javascript, Debugging, Computer Science, Development Environment, Performance Tuning

Status: Free

Status: FreeSkills you'll gain: Grant Applications, Business Development, Entrepreneurship, Financial Analysis, Growth Strategies, Fundraising, Cash Flow Forecasting, Business Strategy, Financial Planning, Finance, Loans, Communication

Status: New

Status: NewCoursera Instructor Network

Skills you'll gain: Compliance Reporting, Prompt Engineering, Compliance Management, Microsoft Copilot, Generative AI, Regulatory Compliance, Workflow Management, Business Process Automation, Data Validation, Operational Efficiency, Artificial Intelligence, Verification And Validation, Automation

Status: New

Status: NewSkills you'll gain: Calculus, Integral Calculus, Computational Thinking, Advanced Mathematics, Derivatives, Numerical Analysis, Mathematical Theory & Analysis, Applied Mathematics

Computational Finance learners also search

In summary, here are 10 of our most popular computational finance courses

- Complete SAS Guide - Learn SAS and Become a Data Ninja: Packt

- 비즈니스와 사회의 글로벌 트렌드: University of Pennsylvania

- Transforming Exploratory Data Analysis with AI: Coursera Instructor Network

- Examina las bases de la ciberseguridad financiera: UBITS

- Goldman Sachs 10,000 Women के साथ, व्यावसायिक वित्त के मूल सिद्धांत: Goldman Sachs

- 응용 전산 유체 역학: Siemens

- GenAI for Call Centers: AI-Driven Customer Success: Coursera Instructor Network

- New Map for Product Managers: Rulesets for Global Business: University of Maryland, College Park

- 70+ JavaScript Challenges - Data Structures and Algorithms: Packt

- Goldman Sachs 10,000 Women के साथ, निधिकरण के मूल सिद्धांत: Goldman Sachs