Filter by

SubjectRequired

LanguageRequired

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired

LevelRequired

DurationRequired

SkillsRequired

SubtitlesRequired

EducatorRequired

Results for "income tax"

Status: Free Trial

Status: Free TrialRice University

Skills you'll gain: Capital Budgeting, Financial Statements, Financial Statement Analysis, Bookkeeping, Probability & Statistics, Financial Accounting, Business Mathematics, Accruals, Accounting, Financial Reporting, Financial Analysis, Income Statement, Accrual Accounting, Statistics, Microsoft Excel, Finance, Data-Driven Decision-Making, Financial Modeling, Cash Flows, Data Analysis

Status: Free Trial

Status: Free TrialIESE Business School

Skills you'll gain: Financial Reporting, Financial Statement Analysis, Corporate Finance, Financial Statements, Financial Accounting, Income Statement, Financial Market, Capital Budgeting, Cash Flows, Accounting, Financial Modeling, Operational Analysis, Financial Analysis, Financial Forecasting, Balance Sheet, Accrual Accounting, Business Valuation, Financial Management, Investments, Equities

Status: NewStatus: Preview

Status: NewStatus: PreviewSkills you'll gain: Facebook, Target Audience, Social Media Content, Social Media Strategy, Content Strategy, Social Media Marketing, Revenue Management, Goal Setting, New Business Development, Live Streaming

Status: NewStatus: Free Trial

Status: NewStatus: Free TrialStarweaver

Skills you'll gain: Financial Statement Analysis, Service Design, Financial Analysis, Change Management, Design Thinking, Social Media Campaigns, Hospitality Management, Social Media Marketing, Income Statement, Social Media, Hotels and Accommodations, Revenue Management, Financial Forecasting, Finance, Strategic Planning, Operations Management, Capital Budgeting, Prototyping, Key Performance Indicators (KPIs), Search Engine Optimization

Status: Free Trial

Status: Free TrialSkills you'll gain: Bookkeeping, Financial Statements, Financial Statement Analysis, Inventory Accounting, Reconciliation, Sales Tax, Income Statement, General Ledger, Payroll Tax, Financial Analysis, Fixed Asset, General Accounting, Balance Sheet, Accounts Receivable, Accounting, Accounting Software, Financial Accounting, Accounting Records, Property Accounting, Payroll

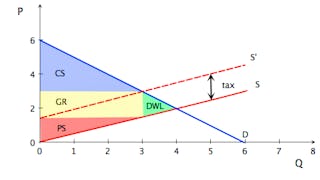

Status: Preview

Status: PreviewUniversity of Pennsylvania

Skills you'll gain: Supply And Demand, Economics, Tax, Cost Benefit Analysis, Market Analysis, Resource Allocation, Decision Making

Status: Free Trial

Status: Free TrialTally Education and Distribution Services Private Limited

Skills you'll gain: Accounts Payable and Receivable, Inventory Management System, Financial Reporting, Bookkeeping, Ledgers (Accounting), Inventory Control, Accounting and Finance Software, Order Processing, Budget Management, Expense Management, Cost Management, Financial Accounting

Status: Preview

Status: PreviewLund University

Skills you'll gain: Law, Regulation, and Compliance, Legal Risk, Regulation and Legal Compliance, Intellectual Property, Artificial Intelligence, Electronic Discovery, Legal Proceedings, Labor Law, Legal Research, Automation, Data Ethics, Criminal Investigation and Forensics, Public Administration, Natural Language Processing, Health Care Procedure and Regulation, Predictive Modeling

Status: Free Trial

Status: Free TrialRice University

Skills you'll gain: Financial Statements, Financial Statement Analysis, Bookkeeping, Financial Accounting, Accruals, Accounting, Financial Reporting, Income Statement, Accrual Accounting, Balance Sheet, Cash Flows, Generally Accepted Accounting Principles (GAAP), Equities

Status: Free Trial

Status: Free TrialUniversity of Illinois Urbana-Champaign

Skills you'll gain: Financial Statement Analysis, Performance Measurement, Financial Analysis, Variance Analysis, Management Accounting, Finance, Return On Investment, Income Statement, Budgeting, Balance Sheet, Financial Management, Accounting, Financial Forecasting, Performance Analysis, Financial Modeling, Financial Statements, Organizational Strategy, Cost Accounting, Equities, Key Performance Indicators (KPIs)

Status: Preview

Status: PreviewUniversità Bocconi

Skills you'll gain: Private Equity, Business Valuation, Investment Management, Entrepreneurship, Entrepreneurial Finance, Financial Management, Financial Analysis, Tax Laws, Due Diligence, Contract Negotiation, Law, Regulation, and Compliance

Status: Preview

Status: PreviewUniversity of Lausanne

Skills you'll gain: Balance Sheet, Financial Statements, Financial Statement Analysis, Income Statement, Bookkeeping, Cash Management, Financial Accounting, Cash Flows, Accrual Accounting, Financial Analysis, Accounting, General Accounting, Accounts Payable and Receivable, Reconciliation, Operational Efficiency

In summary, here are 10 of our most popular income tax courses

- Business Finance and Data Analysis Fundamentals: Rice University

- Think like a CFO: IESE Business School

- Facebook Monetization: Collaborate with Brands: Coursera

- Strategic Leadership in Hospitality: Starweaver

- Intuit Academy Bookkeeping: Intuit

- Microeconomics: The Power of Markets: University of Pennsylvania

- Principles of Accounts Payable and Receivable Management : Tally Education and Distribution Services Private Limited

- AI & Law : Lund University

- Accounting for Non-Finance Professionals: Rice University

- Financial Analysis - Skills for Success: University of Illinois Urbana-Champaign